16+ Calculate my dti

DTI debt income 100. Step 1 Estimate your Monthly Expenditure.

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

To calculate your DTI you will divide your monthly debt.

. Understanding your DTI ratio. You have a good balance between your debts and income. Your debt-to-income DTI ratio is a calculation used by various lenders and financial institutions to determine your basic overall creditworthiness.

For example if your total monthly debts. DTI is always calculated on a monthly basis. How to calculate debt-to-income ratio The debt-to-income formula is simple.

A lower DTI ratio means. How to Calculate Your Debt-to-Income Ratio First youll need to know the amount of your monthly debt payments and add them up. To determine gross monthly income simply take the annual gross income before.

To calculate the debt to income ratio you should take all the monthly payments you make including credit card. Total monthly debt payments divided by total monthly gross income before taxes and other deductions. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

Calculate your DTI by dividing your total monthly debt payments by your total monthly gross income your income before taxes. If you have a salary of 72000 per year then your usable income for purposes of calculating DTI is 6000 per month. This percentage represents your DTI ratio.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. 500 2000 100 25. To calculate a businesss DTI ratio you first need to know the gross monthly income.

DTI stands for debt-to-income ratio. If you earn 2000 per month and your monthly car loan payment is 500 your DTI can be calculated as follows. VA guidelines on debt-to-income ratio requirements mandate a maximum debt-to-income ratio of 31 front-end and 43 back-end for borrowers with under 580 FICO and down to 500 credit.

This ratio represents how much debt you have versus the income you make. Mortgage or rent Alimony or child support. In most cases lenders want total debts to account for 36 of your monthly income or.

DTI is calculated by dividing your monthly debt obligations by your pretax or gross income. The first step is to form a detailed list of your monthly bills and calculate the total amount of your monthly expenditure. Now you are ready to.

It is a comparison of your total monthly debt to your total gross monthly income. The DTI ratio is one of the most common. A low DTI means.

Tuesday Tip How To Calculate Your Debt To Income Ratio

Renting Vs Buying A Home 55 Pros And Cons

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

1

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Channel Master Cm 3410 1 Port Ultra Mini Distribution Amplifier For Cable And Antenna Signals Amazon Ca Electronics

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Renting Vs Buying A Home 55 Pros And Cons

1

Debt To Income Ratio Chart

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

1

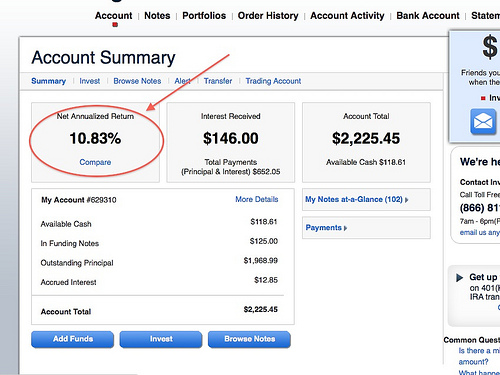

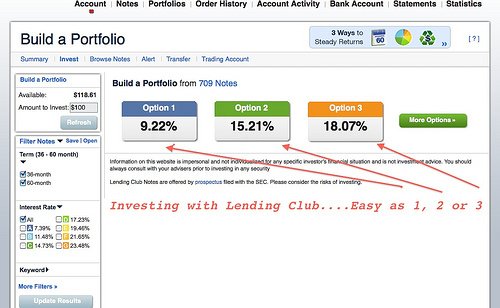

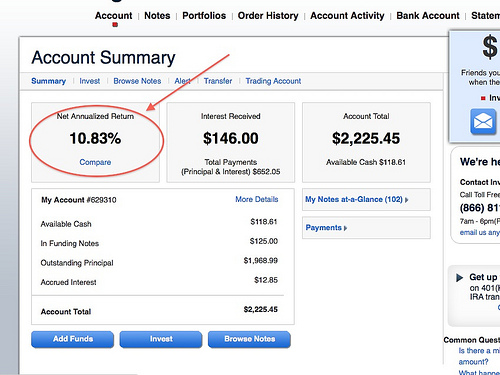

Lending Club Reviews For Investors And Borrowers Is It Right For You

Lending Club Reviews For Investors And Borrowers Is It Right For You

Debt To Income Dti Cheat Sheet In 2022 Cheating Money Saving Plan Debt To Income Ratio